Wall Street Wins Again

So, what kept GME afloat?

February 6, 2021

One post on r/wallstreetbets displays, “The real reason Wall Street is terrified of the GME situation”. While this post is true when referring to the hedge funds eviscerated by the rise of GameStop, many other institutional firms currently benefit from the stock jump initially sparked by retail traders. Many r/wallstreetbets contributors stress their comrades to ‘hold the line’ and to not sell.

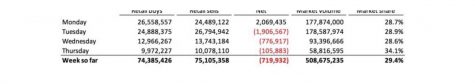

Yet, recent data from Citadel Securities indicates that, during the week of the jump to the $450 high, there was more selling pressure from retail speculators than there was buying pressure. While the data signals that most retail traders have lost their cool to hold GME until it reaches $1000, it also indicates that the price of GameStop stock should have been lower than the week’s starting price of $96. But, during that week, GME was still at an astounding $325. So, what kept GME afloat? One may infer that the market makers are back in the game.

Algorithmic high frequency traders, other hedge funds, and trading firms are capitalizing on the high volatility and frothiness of GME. While the retail traders burned Melvin Capital and friends, other hedge funds are still exploiting uninformed and ill equipped retail traders, having faster trading abilities, broader analysis, and greater access to market data. Further, traders think they are hurting the hedge fund managers, but they fail to understand that most hedge fund managers have a small position in their own funds when compared to their lofty personal portfolios. And, by targeting hedge funds, robinhood traders are actually jeopardizing their fellow Americans’ futures because most of the capital in hedge funds are invested from already underfunded pension funds, which promise retirement funds for blue collar workers. To top this all off, executors of trades on Wall Street, such as Citadel Securities and Virtu Financial, gain profit from the massive trade inflows from retail speculators.

One constant of this turmoil is that no money is created by trading; trading is just people exchanging financial instruments. Rather, money is actually lost due to financial intermediaries and croupiers, which charge transaction fees or capture the difference between the buying and selling price of a trade; better known as the spread. As the Oracle of Omaha, Warren Buffet, says, “For investors as a whole, returns decrease as motion increases.” The net result of trading is negative and actually benefits market makers, which means that retail traders as a whole are still losing the uphill battle against indestructible and tyrannous Wall Street. I hope that many r/wallstreetbets gamblers, after this wrenching event, convert to the much more predictable, sensible, and honorable passion of investing for the long term. My favorite group of long term investors are the Boglehead indexers along with the avid value disciples of Warren Buffet. To play off Martin Luther’s famous hymn, “A Mighty Fortress Is Our Wall Street”.

Note – As of February 4th, GME trades at $49. Losing nearly 87% of its value since its high. For every trade there is a winner and a loser, but the ultimate winner is Wall Street. A quote to all traders, “The last shall be first and the first last” – The Gospel of Matthew.

Source: Citadel Securities