Be Worried?

Always the bearer of bad news when it comes to investing

December 8, 2022

Greetings. Always the bearer of bad news when it comes to investing, I have returned once again. This time, I will cover my Economics class’s journey into the Stock Market Game, a mock trading game in which teams compete against local New England students. Additionally, I will examine the Investment Club’s MarketWatch game, a similar mock trading game.

In this article I hope to compare the returns of BC High students relative to the S&P 500, a market cap based index which tracks the largest publicly traded American companies. The S&P 500 serves to act as a common benchmark for most investors, and displays the average return of all American investors. By comparing performance relative to the S&P 500, one can observe the profound financial skills and investment returns of high schoolers (hint: they aren’t very profound, in fact, they are quite dismal).

Stock Market Game:

In Economics class, we started on September 30th. At the time, the S&P 500 was at 3585.62. As of this article’s creation, November 13th, the S&P 500 is at 3992.93. This equates to an 11% return over the past month and a half.

During that time period, teams bought, sold, shorted, and traded various securities such as bonds, stocks, money market funds, and mutual funds. The result was a disaster. Out of 1037 teams in our region, only 55 managed to outpace the S&P (of 100 people, 95 managed to lose. A paltry 5% success rate).

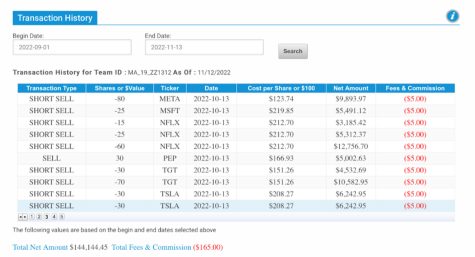

As for my team, we currently have around $91,000 (a -8.1% return since the start). We managed to rank 1016 of the 1037 teams and placed at the bottom 2% of all teams! (We didn’t even manage to be #1 at being the worst team, there really is nothing to brag about, how disappointing).

What did we do to end up in financial ruin? Well, first, we shorted at a market trough; killing us as the market rebounded from its lows. And second, a lack of diversification. We took large short positions in volatile stocks like TSLA and NFLX, which, when they rebounded, hurt us especially.

Our team has learned from our mistakes. As of now, we’ve gone entirely into stable cash and government bonds, which also caused us to miss the 5% jump in stocks, furthering our lackluster performance (an example of great market timing). So, perhaps investing just isn’t our thing. The three of us better find good paying jobs, hope for low inflation, and open a savings account that has a good interest rate.

MarketWatch:

The MarketWatch game with the Investment Club generated better results than the Stock Market Game, although still lacking. The game started on October 17th, and the S&P returned 10.3% in that time. The average return of a club member’s portfolio was $9,400, or 9.43% (still lagging, but not as bad as my Econ class). 14 out of the 44 participants achieved returns superior to the S&P (a 31% success rate or a 69% failure rate depending if you are a glass half full or half empty person). Even with better performance, BC High students, on average, have yet to outperform a passive benchmark.

So what have we learned from our journey into the investing world? Obviously, to stay out of it. Just kidding. We’ve learned the following:

- Properly diversify between asset classes to diminish risk

- Have sensible timing when entering and exiting positions (don’t sell at a market bottom, and don’t buy at a market peak)

- Buy an unmanaged, low cost index fund (it beat 95% of the participants in the Stock Market Game and 69% of the Investment Club)

- Be scared for America’s future (three out of four BC High students go into business, let’s hope their personal finance skills either improve during college or are not correlated with their business knowledge)

As of now, my only solution for our abundance of poor returns and lack of financial literacy is divine intervention. Let’s collectively say a prayer for our young Americans entering the world of personal finance and hope that scientists soon develop actual money trees (I am sure Mr. Argento would scoff at this idea: inflation, inflation, inflation). Two, let’s hope that America’s billionaires ascribe to the Gospel of Wealth and begin to dole out their fortunes through social programs. And third, let’s hope for the second coming of Christ, for he will separate the money changers from the beggars.

Current Holdings

S&P Return since October